Recent Blog

How to Send Money to the Philippines from the USA Using BCRemit’s New App: A Step-by-Step Guide

Sending money to the Philippines from the USA has never been easier with BCRemit’s new app. This innovative app streamlines the process, making it quick and convenient for users to transfer funds to their loved ones. Whether it’s for family support, paying bills, or any other purpose, BCRemit ensures your money gets where it needs to go efficiently.

To get started, users can download the BCRemit app from their respective app stores. The app guides you through the setup process, ensuring even first-time users can navigate the platform without any issues. With just a few taps, you can execute a money transfer, monitor the transaction, and receive real-time updates on its progress.

The app not only simplifies the transfer process but also offers competitive exchange rates and low fees. This means you get to send more money home without worrying about high costs. BCRemit has made it their mission to provide a reliable and user-friendly service, catering to the needs of the Filipino community abroad.

Key Takeaways

- BCRemit’s new app simplifies sending money from the USA to the Philippines.

- The app is user-friendly and offers competitive rates.

- Real-time updates ensure transparency and reliability.

Getting Started with BCRemit

Sending money to the Philippines using BCRemit’s new app is simple and efficient. Users can easily download the app, create an account, and verify their identity within a few steps.

Download and Installation

To begin, users need to download the BCRemit app. The app is available on the App Store for iOS devices and the Google Play Store for Android devices. Search for “BCRemit” and click on the install button. The app will download and install automatically.

Once installed, open the app and allow any necessary permissions, such as access to photos or contacts. This ensures that the app functions properly. Users are then prompted to set up their account.

Creating an Account

After downloading the app, the next step is to create an account. Open the BCRemit app and tap on the “Sign Up” button. Users will need to provide basic information such as their full name, email address, and a secure password.

An email will be sent for verification. Clicking the link in this email will confirm the account. Users must then log in with their email and password. The app may prompt users to set up additional security measures, like two-factor authentication, to further protect their account.

Verifying Your Identity

Verification is crucial for secure transactions. To verify their identity, users must provide a valid government ID, such as a passport or driver’s license. The app will guide them through taking clear photos of the ID.

After submitting the ID, users may need to take a selfie for facial verification. This step enhances security and helps prevent fraud. Verification might take a few minutes to several hours, depending on the volume of requests. Once verified, users can start sending money to the Philippines with confidence.

Executing a Money Transfer

BCRemit’s app makes sending money to the Philippines from the USA straightforward and reliable. Here are the steps to complete a transfer using their new app.

Inputting Transfer Details

To start, the user must enter transfer details. This includes the recipient’s full name, phone number, and bank account information or cash pickup point. Accuracy is key to avoid delays or errors.

A clear user interface guides through each field. Ensure all details match the recipient’s bank records. If sending to a cash pickup location, choose the site closest to the recipient.

After confirming the recipient’s details, double-check everything before proceeding. Any mistake could lead to issues that may cause delays or require customer support intervention.

Selecting Payment Methods

BCRemit offers multiple payment methods for convenience. Users can choose to pay with a bank transfer, debit card, or credit card. Each method has its own steps and processing times.

For bank transfers, the app provides the necessary bank details. Entering the correct details is crucial. Debit and credit card payments require entering card numbers, expiration dates, and security codes.

They may include extra security measures, like two-factor authentication. Choose the most suitable payment option based on speed, cost, and personal preference.

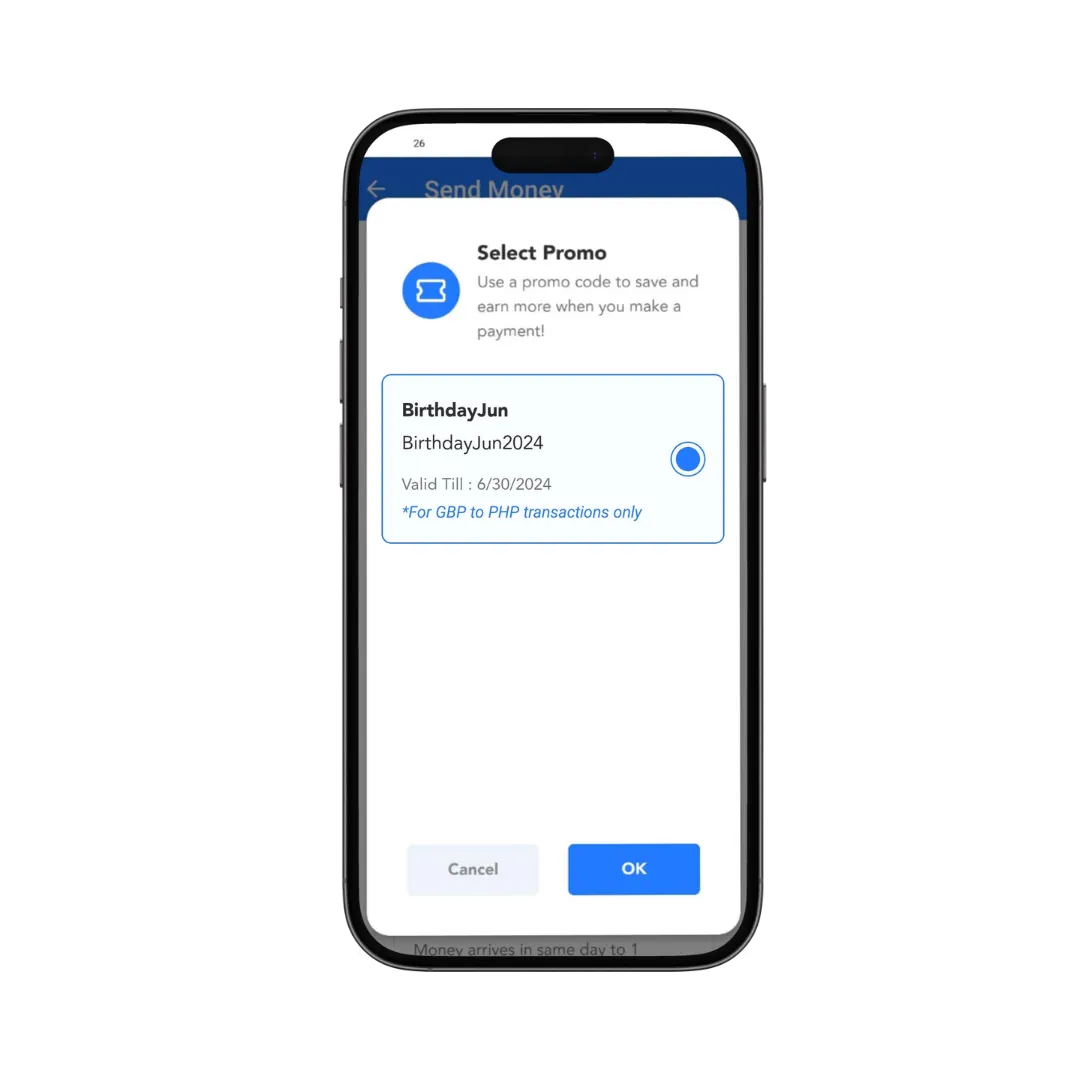

Reviewing Transaction Costs

Before finalizing, review all transaction costs. BCRemit typically displays these clearly, including exchange rates, transfer fees, and any additional charges. This is essential for transparency and ensuring the user knows the total cost.

The app might offer exchange rate calculators. These help compare the rate offered by BCRemit and let the user see the exact amount the recipient will get.

Be aware of any hidden fees. Ensure that the amount sent meets the receiver’s needs after all deductions. This step helps avoid any surprises and provides clarity on the final amount delivered to the recipient.

After the Transfer

Once the money transfer is complete using BCRemit’s new app, you can track the status of your transfer and receive notifications. These features make it easy to stay informed about your transaction.

Tracking Your Transfer

BCRemit provides a tracking feature that lets you monitor the status of your transfer in real-time. After making a transfer, you can log into the app and view updates on the progress. The tracking tool shows when the money is being processed, when it is out for delivery, and when it has been received.

This knowledge helps users stay informed about their transactions. Knowing the exact status of your transfer can provide peace of mind and ensure that the intended recipient receives the money as expected.

Receiving Notifications

BCRemit’s new app also sends notifications to keep you updated. Once the transfer is processed, the app will send alerts about key stages. Users can receive notifications when the transfer is initiated, processed, and successfully delivered.

These alerts can be adjusted in the app settings to suit your preferences, ensuring that you receive timely updates wherever you are. Users can opt for push notifications, SMS, or email alerts, providing flexibility and accommodating various communication needs.

Subscribe to our Newsletter

Our Global Presence

🌐 Online Services Available Open 24/7

-

Sunday: Open 24 hours

-

Monday: Open 24 hours

-

Tuesday: Open 24 hours

-

Wednesday: Open 24 hours

-

Thursday: Open 24 hours

-

Friday: Open 24 hours

-

Saturday: Open 24 hours